Paying down debt with a method is a sound monetary determination. There are a number of methodologies for doing this, together with the debt snowball and debt avalanche. Is one by some means higher than the opposite? It relies on your private scenario. For these with extreme high-interest bank card debt, there’s a vital distinction between the 2.

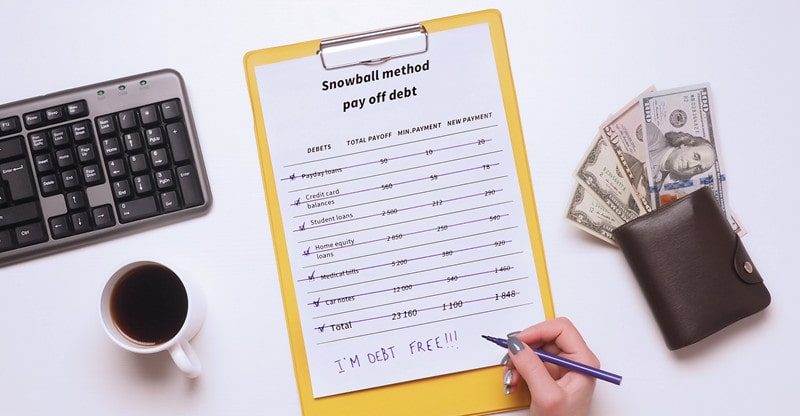

Earlier than we dive in, it’s necessary to notice that you can merely apply for a debt consolidation mortgage and keep away from having to choose both debt payoff plan. If that’s not an choice, evaluate debt snowball first. It’s the best methodology, nevertheless it has some limitations. The tactic focuses on paying the smallest steadiness first, no matter rates of interest. Are you able to see the place that is likely to be an issue?

The Flaws of the Debt Snowball Technique

Add up all of your debt. The overall you arrive at will develop with every passing day. Accounts with increased rates of interest develop quicker than others. When you go away them for final, that curiosity will proceed to accrue, slowing down your payoff technique. In an ideal world, the place all rates of interest are equal, it doesn’t matter. In the true world, although, it makes a distinction.

View this situation by way of the debt snowball methodology: Let’s assume that your largest balances are additionally the accounts which have the very best rate of interest. You’ll really feel instantaneous gratification once you repay small accounts, however these different balances will proceed to develop at a fast clip. You’ll make minimal funds on them whereas working in your debt snowball, however that received’t cowl a lot of the principal.

Now visualize arriving at a high-interest debt within the payoff plan. It’s going to take you longer to pay as a result of the rate of interest remains to be being charged for what is going to seemingly be nearly your complete steadiness you began with. Had you paid it off early, you wouldn’t be in that place. This is among the key flaws within the debt snowball methodology, and why you probably have numerous high-interest debt, you need to keep away from it.

Making use of the Debt Avalanche Technique

A debt avalanche works otherwise than a debt snowball. Reasonably than prioritizing smaller balances first, it focuses on the accounts with the very best rates of interest. That debt is the place you place your extra funds. By doing this early within the debt payoff course of, you get rid of the accounts that develop the quickest and reduce the period of time it can take to finish your complete plan.

We might present you some mathematical examples right here, nevertheless it’s higher to grasp these two ideas conceptually. Simplified, debt avalanche is quicker and can in the end prevent cash. Debt snowball gives instantaneous gratification and small wins early on, but you’ll nonetheless must take care of that high-interest debt in some unspecified time in the future. Why not sort out it from the beginning?

Considered one other means, your goal is to turn into debt-free, so simply selecting a debt payoff methodology is an enormous step. When you really feel you want a way of accomplishment in that space early, go together with the debt snowball methodology.

These with a extra long-term outlook on their funds ought to go together with the debt avalanche methodology. Or, you can simply apply for a debt consolidation mortgage and start making funds on all your money owed without delay. It’s a lot easier.

Sources:

https://www.debt.org/recommendation/debt-snowball-method-how-it-works/

https://www.ramseysolutions.com/debt/debt-snowball-vs-debt-avalanche